Our experiences with IFRS 16 implementation

This is an extract from an article written by Terje Glesaaen in collaboration with KPMG partner Serge Fjærvoll. It was published in the professional publication “Revisjon og regnskap” in December 2019.

The first part is based on interviews with companies that have undergone a comprehensive implementation of IFRS 16 in 2018 and early 2019 with different types of software solutions.

IFRS 16 has been a comprehensive accounting standard to implement

Several companies do not have an overview of resource use during an IFRS 16 implementation and of those who would give an estimate, the lowest estimate was a quarter of a man-year (internal plus external). Some stated that there were many people and functions involved, both centrally at group level and out in the units. The companies have used external accounting advisers to a limited extent, but raised questions with their auditor and attended external courses.

Many companies we have spoken to had acquired externally developed software for mapping and calculations. They experienced that changes occurred in the systems along the way and that no suppliers had fully developed solutions. Companies that chose an integrated system, which was further developed especially for the company in question, spent a lot of resources on quality assurance and that they had to pay for the development.

Most indicate that overall resource use was higher than expected.

Organization and training

All the companies we spoke to either had a project group, or were given instructions and guidance from the group. Business areas or units were given responsibility for mapping and assessment to a greater or lesser extent. Some read contracts and made calculations at group level.

Several of the interviewed companies have a decentralized reporting structure where they rely on reporting from subsidiaries. We understand that training and understanding what must be reported has been time-consuming. IFRS 16 has effects on many reporting units and can hardly be entered “at the top” in the consolidation without being distributed among the units. On the other hand, in many cases IFRS 16 cannot be used in local accounts. Separating these effects requires separate elimination units, journals and separate accounts.

After implementation, there is a need to register new contracts and account for changes to contracts. This creates a continuous need to focus on IFRS 16 in the organisation.

IFRS 16 implementation – choice and method

Everyone we have spoken to has used a modified retrospective method. Furthermore, there are no clear common denominators for which practical exceptions and adaptations have been chosen. Many have chosen not to include short contracts and low value assets. Service elements (typically joint costs) have been included in the rental amounts recognized in the balance sheet, portfolio assessments have been used and certain leases have been calculated back in time to obtain lower depreciation going forward.

Overview of rental agreements

Companies with decentralized performance responsibility and structure have in many cases not had central registers of contracts and have previously relied on reporting from the companies for note information on contractual obligations in accordance with IAS 17. With the introduction of IFRS 16, a common method has been to review the ledger to identify the lease agreements. There was soon a need for systems to register contracts and information to make IFRS 16 calculations. Previously obtained information turned out to be insufficient, and several of the companies thus gained a better overview after the contract review.

Companies that have many lease agreements from the same supplier(s) have to some extent agreed that the supplier(s) shall provide periodic overviews of lease agreements with key information, which the company uses to update its calculations. This may be relevant for car leasing and machines and equipment that are hired in large quantities for projects.

New requirements for routines and internal control and reporting going forward

To a limited extent, the companies we interviewed have established and documented policies and procedures for identifying and handling changes, determining whether there are changes that affect the result or the balance sheet and making new calculations. This is something the companies will continue to work on in the future and is part of the company’s IFRS 16 implementation. It can be complicated and requires a good understanding of the standard and it would be an advantage if complicated changes in the calculations are only made by a small number of people with sufficient insight into IFRS 16.

Data and specifications for note information and additional information for the 2019 annual accounts have to a small extent been the focus of the companies during implementation. Some will adapt the internal report package for annual accounts reporting to bring in additional data.

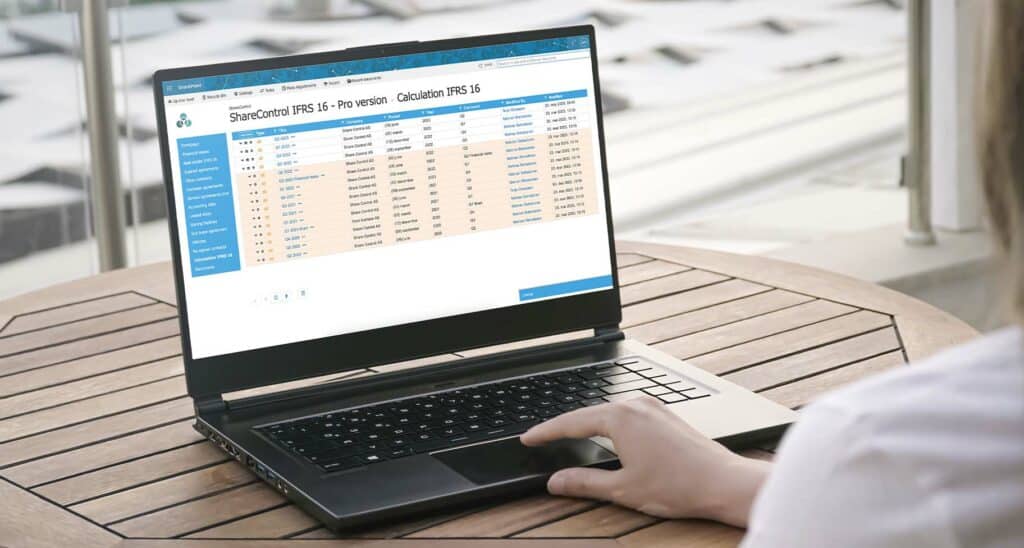

Read more about ShareControl IFRS 16 software

We are here to help you! Contact us already today >>