Written by Terje Glesaaen

IFRS 16, which deals with rental contracts (leasing agreements), entails major changes for companies that rent operating assets. The accounting standard has been standard for listed companies since 2019. But to understand the accounting standard, it is important to know what a rental/leasing agreement is.

What is a lease agreement?

A lease a contract that transfers the right to use an asset for a period of time in return for consideration. It is therefore a prerequisite that the right to use the asset is transferred from the seller to the lessee, against a financial consideration. The identified asset can also be part of an asset, typically premises in the form of a floor or similar. In this case, the building will be the asset, while the floor or premises will be part of the asset.

What is a lease according to IFRS 16?

IFRS, 16 what is a leasing agreement? According to the standard, the definition is “an agreement, or part of an agreement, that will transfer the right to use an asset (the underlying asset) for a certain period of time in exchange for compensation”. The question is crucial to being able to answer whether an asset constitutes a lease in accordance with IFRS 16. All criteria should be met for the agreement to be considered a lease.

Read also: IFRS 16 assessments and interpretation of leases raise many questions.

Lease agreements according to IFRS 16 only include agreements for the lease of physical fixed assets such as operating assets, property, production facilities, etc. A lease agreement according to IFRS 16 therefore includes the same requirements as in the old standard, IAS 17.

Three matters for IFRS 16, what is a leasing agreement

To define what constitutes a leasing agreement according to IFRS 16, there are three key questions:

Is the asset identified or not?

The first question for IFRS 16. What is a lease agreement linked to, whether the agreement is linked to an identified asset or not. Access to the asset can be expressed explicitly in the agreement. For example, in the 1990s, the European Parliament by referring to specific premises, a car with a registration number or a computer with an identification number. However, the asset may also be implicitly expressed by the supplier, not having the practical possibility to replace the asset for a period of time. The latter, for example, usually applies to copy machines. Even if the supplier has the right to exchange one copier with the customer for another, it will probably cost the supplier more to carry out an exchange than could be gained from the exchange. In any case, the copier is an identified asset.

Financial benefits from the lease

The second question for IFRS 16. What constitutes a lease is about whether or not the lease receives substantially all of the economic benefits from access to the object. A lessee who has an agreement for an asset used by several parties can rarely be considered to receive substantially all economic benefits. If the agreement is not linked to physically separate parts of a larger asset. For example, it can refer to a fiber cable used to transmit data. If only one party has the right to use the fiber cable, this may lead to the conclusion that the agreement constitutes a lease agreement. However, if the lessee is not entitled to substantially all economic benefits, the agreement does not constitute a lease according to IFRS 16.

The use of the asset

Finally, what is the definition of a lease? The third question concerns whether the lessee determines the use of the asset. The decisive factor is who controls the purpose of and how the asset is used. This is the case, for example, usually not that practically handles an asset. A machine that requires a special driver’s license to perform the service need not necessarily be excluded from being a rental agreement. Even if the supplier provides the customer with such drivers. The decisive factor is who decides what is to be carried out with the machine and when. That is, the person who controls the purpose of and how the machine is used.

Software solution for handling lease agreements

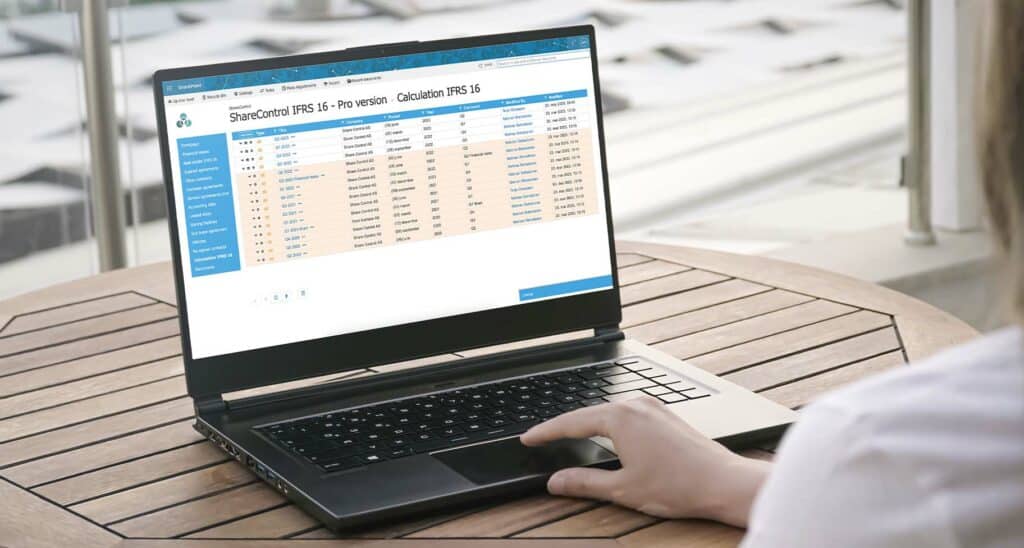

We help make compliance with IFRS 16 lease accounting standards easy. Save time and ensure accurate financial reporting with our user-friendly IFRS 16 system.

ShareControl IFRS 16 allows the user to easily import lease agreements from other systems, such as finance and ERP systems – so that all lease agreements are stored and processed in one place. The system captures lease agreement data such as lease period, payment plan, interest rate and other necessary information for calculations.

Achieve accurate financial reporting with a step-by-step guided process to ensure correct identification and classification of your deals. With automatic calculations, you can also automate and streamline parts of the work.

Explore the possibilities with ShareControl IFRS 16 here!