Add-on to MICROSOFT 365 sharepoint

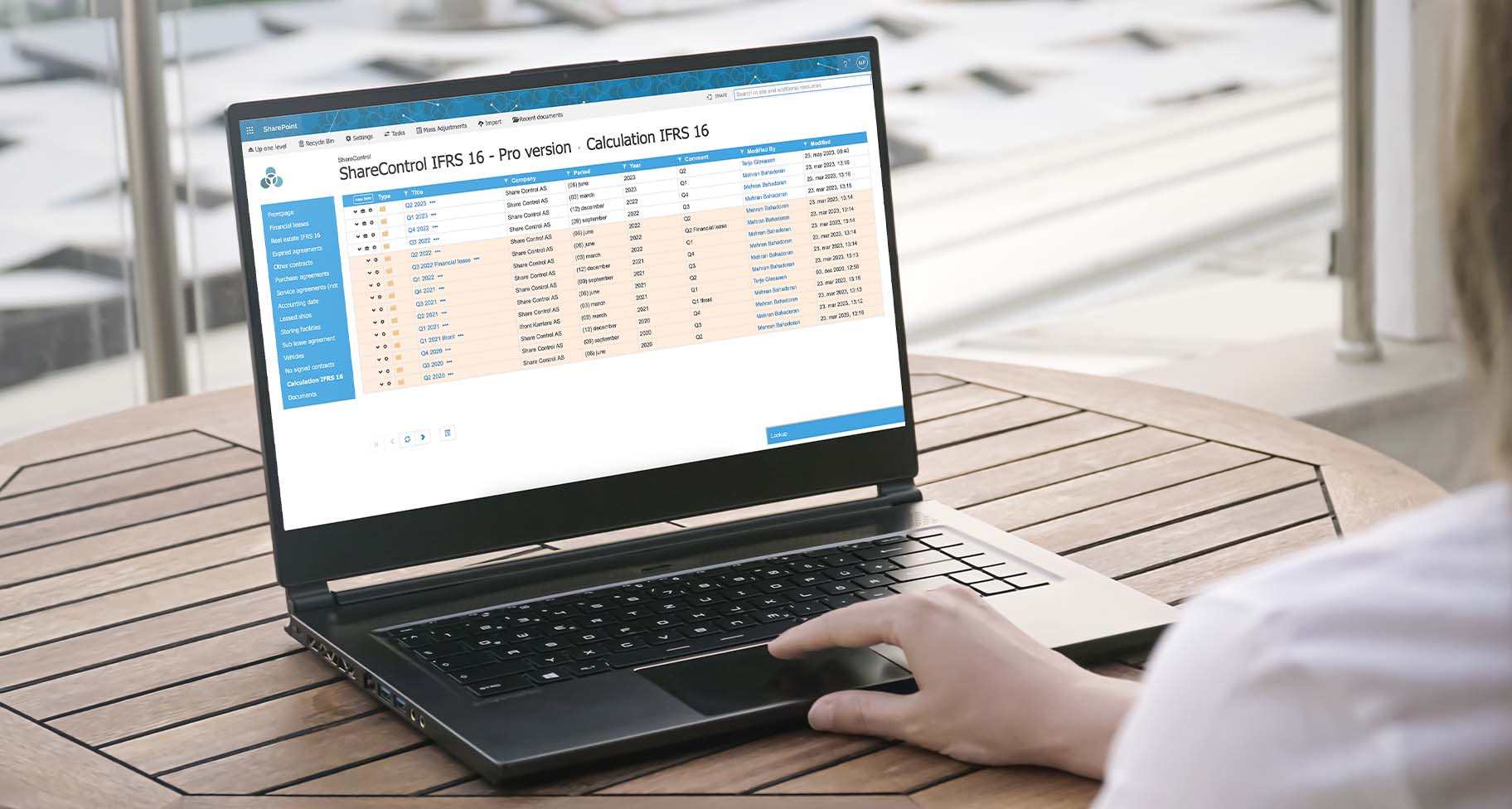

IFRS 16 Software

We help make compliance with IFRS 16 lease accounting standards easy. Save time and ensure accurate financial reporting with our user-friendly IFRS 16 system.

With the introduction of the IFRS 16 standard for lease agreements, companies have experienced an extensive impact on their accounting and finance processes, systems and financial reporting.

Share Control’s IFRS 16 lease management software lease accounting and IFRS 16 compliance easy.

ShareControl’s IFRS 16 software include:

- Import of lease data.

- Guided process for determining lease classification.

- Automated calculations.

- Periodic adjustments and general ledger postings.

- Integrate automatic reporting into your accounting or consolidation system.

- Reporting also possible via Power BI and Excel

- Includes audit trail for periodic and annual changes.

Get a demo of IFRS 16

Simple import of new lease contracts

Easy import of lease contracts from other systems.

The import captures lease contract data such as lease period, payment schedule, interest rate and other necessary information for calculations. If all the required information is not available in the contract, it can be added manually after the import is complete.

Advantages of the ShareControl IFRS 16 software

User friendly

All-in-one IFRS 16 lease accounting system for simple administration and control of all the company’s lease agreements and IFRS 16 compliance.

Simple audit

Our solution is built on Microsoft 365 and easily accessible in Sharepoint. This makes it easily auditable for auditing and internal control.

IFRS 16 expertise

Our IFRS 16 expertise provides security for you as a customer. We have extensive experience in IFRS 16 reporting for large and small companies.

Selected customers

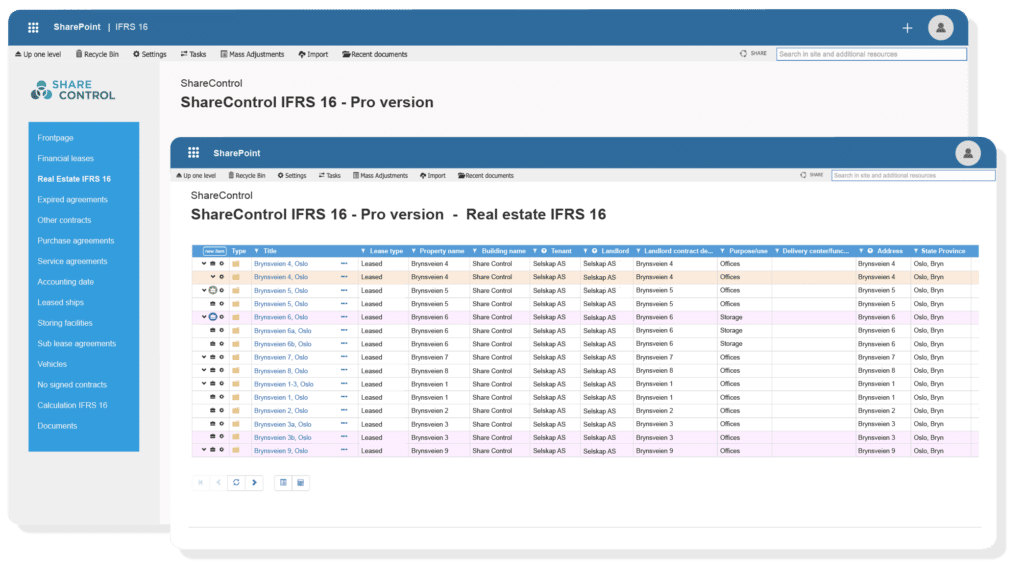

Easy identification and classification of lease contracts

ShareControl IFRS 16 provides you with a user-friendly and structured solution that guides you through a step-by-step process to correctly identify and classify your leases. The solution helps you distinguish between finance and operating leases, while ensuring that you meet the requirements of the IFRS 16 standard

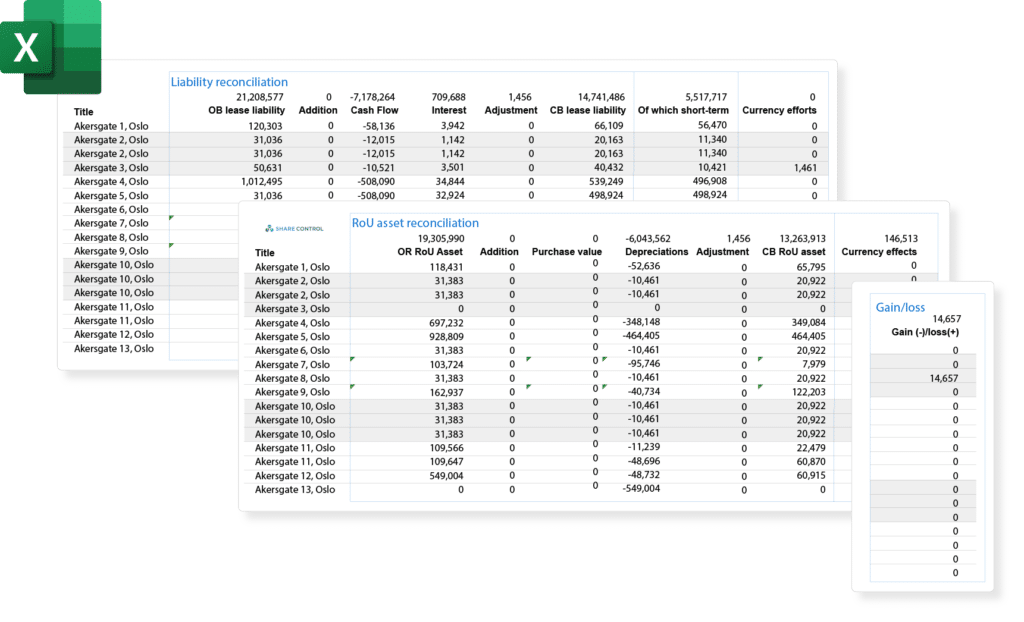

Automated calculations of rental liability and right of use assets

The Share Control IFRS 16 software will also calculate the value of the right of use assets at the start of the lease. This includes the initial amount of the lease liability, in addition to any lease payments made at or before the start of the lease, less any lease incentives received.

Automatic periodic adjustments and general ledger postings

Accounting entries will be specified or automatically registered via the integration with your accounting system.

For each lease payment made, the lease liability will be reduced and an interest charge will be calculated based on the remaining lease liability. The right of use asset will also be depreciated over the lease period.

Easy and automatic transfer of general ledger postings to the most used accounting and financial reporting systems can be connected.

Option to correct errors in previous periods with cumulative effect in the selected accounting period.

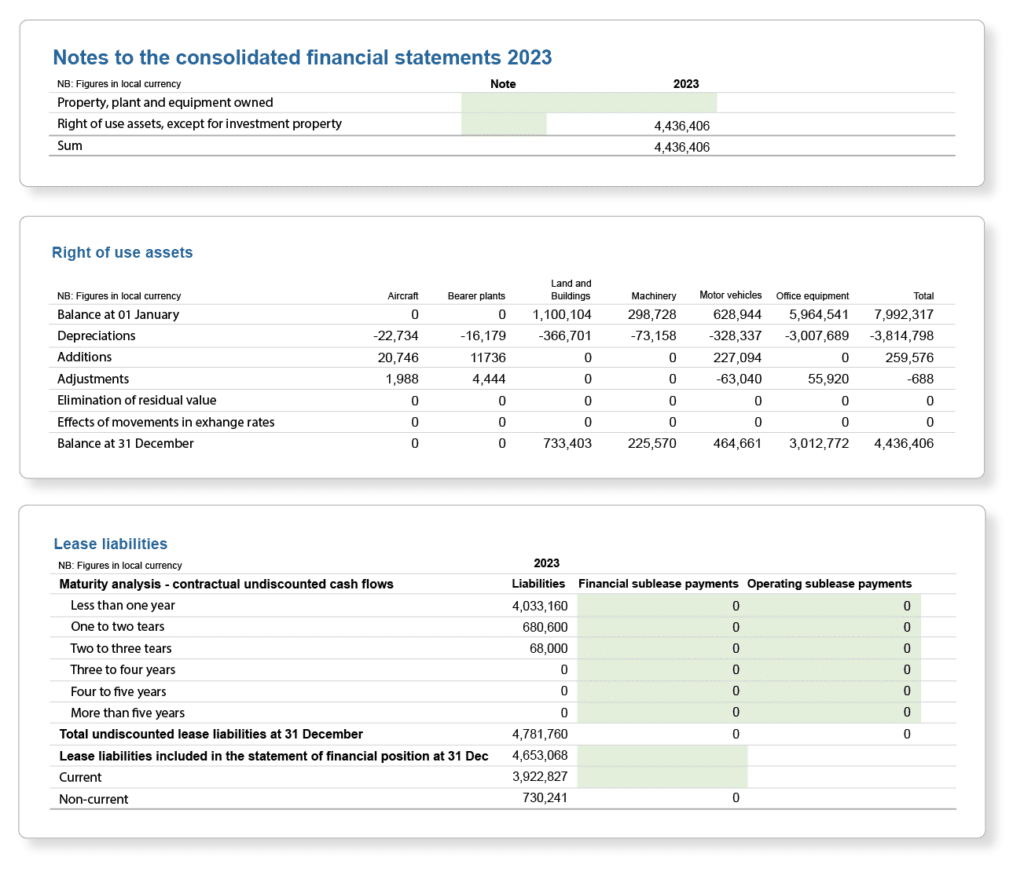

Update financial reports automatically

The Share Control IFRS 16 software will automatically generate the necessary general ledger postings and financial reports, including depreciation plans and other important rental measurement values, so you can easily manage your rental portfolios and meet your financial reporting requirements.

Watch a quick demo

If you need a demonstration of specific IFRS 16 features such as reporting, options for integration with your accounting and reporting tools, we would be happy to show you more.

Integrates with your other financial systems

The ShareControl IFRS 16 system is a SharePoint add-on to your own Microsoft 365 platform, and integrates with your existing accounting and consolidation/reporting system.

With a seamless integration, you can completely automate your accounting entries and financial reporting.

Additional options:

Power BI solution – analyzes and reports and simplified access to contracts, metadata and calculations

Secure data storage in your own Microsoft 365 environment

ShareControl IFRS 16 is an addition to Sharepoint. Simply put, it’s like a SharePoint app added on top of your existing Microsoft 365.

This means that all your data is stored within your own secure network, on your Microsoft 365 platform with your own user access control.

Find ShareControl IFRS 16 in the Microsoft App Store

Data processor agreement – No additional data processor agreement is required beyond your current Microsoft 365 agreement.

Do you want to know more? Book a meeting with us here!

We Help You Get Started

Because ShareControl IFRS 16 is a Microsoft 365 add-on, the setup is very “smooth”. We load the ShareControl app and help you configure IFRS 16 to meet your needs.

We’ll also help you transfer data and documents to our Microsoft 365 add-on, so you’re up and running quickly.

Optional integration

ShareControl IFRS 16 can report via Excel-VBA and Power BI. But if you need integration to your consolidation or accounting system such as Cognos, SAP, HFM, Visma, Agresso or others, then we can help.

Define

Configure to match the IFRS 16 process, contract types, metadata for reporting needs and more.

Data transfer

We help you transfer your contracts so that all the data is in one place in the Microsoft Office 365 environment.

Integration

Optional integration to major reporting and financial systems such as SAP, Visma, HFM, Cognos, etc.

Support

You get training and support as part of the setup and access to our large library of guides for ongoing training.

Advantages of ShareControl IFRS 16 PRO

Fixed asset note

The Fixed Asset Note in ShareControl IFRS 16 provides detailed information on the company’s fixed assets, including values, changes, and lease agreements relating to these assets.

Forecasting

The forecast function in ShareControl IFRS 16 provides accurate estimates of future rental costs and financial obligations, based on existing leases and applicable accounting rules.

Our products

Contract Management

Contract and agreement management for overview and control.

Transparency Act

A place to handle all data and processes around the Transparency Act.

SMB Complete

Get control, overview and efficient sharing of the company’s documents.

Board portal

Effective board work in a safe and secure manner.