Norwegian companies published a report for the second time in accordance with the Transparency Act in June 2024. We see an improvement in the businesses, but there is still potential for improvement in connection with the discovery of actual and potential negative consequences and the implementation of measures. What does the business do if negative consequences in accordance with the Transparency Act are revealed? This article deals with the negative consequences and how the businesses must report for this and how measures must be implemented.

Negative consequences in the Transparency Act

The Transparency Act requires businesses to carry out due diligence assessments to map actual and potential negative consequences for basic human rights and decent working conditions. This means that companies must evaluate the risk in their entire value chain, both locally and globally.

What are negative consequences?

Negative consequences according to the Transparency Act can be defined as activities or events that can or have led to negative consequences for human rights and working conditions. Negative consequences can therefore be violations of employee rights, discrimination, slave labour, child labour, violation of indigenous people, poor health and safety, or other dangerous and unfair working conditions. When this is identified, the business must immediately take the necessary measures to manage and reduce these consequences. Regular reporting on how these risk assessments are followed up is an important part of compliance with the law.

Furthermore, the law will require businesses to openly report on what measures have been put in place to improve the situation and possibly what results have been achieved through this work. If the business has just started a measure when the report is published, the expected outcome of the measure must be presented. This contributes to increased transparency and accountability from companies, both nationally and internationally.

If negative consequences should occur, companies will also have to communicate how these are handled, to ensure that human rights are safeguarded and improvements achieved where necessary.

Read also: Anchoring accountability in the Transparency Act

Examples of negative consequences on basic human rights and working conditions

Negative consequences for violations of human rights and working conditions are not always easy to detect in the supply chain. Good knowledge and thorough due diligence assessments are therefore essential to ensure compliance with the legislation.

Examples of negative consequences in the supply chain could be that the business unwittingly benefits from workers who are exposed to human trafficking or forced labour, for example from computer components in Asia. If we look, for example, at the high-risk list of DFØ (norwegian), we see that there is a high risk of negative consequences in the assembly of computer screens in China, with child labour, forced labor and bonded labor as the biggest risks. Good routines and processes in the due diligence assessments are therefore essential to uncover subcontractors with a risk of negative consequences for violations of human rights and working conditions.

Read more about examples of negative consequences for human rights here.

This is how you report negative consequences in accordance with the Transparency Act

The purpose of the Transparency Act is to promote respect for human rights and decent working conditions in Norwegian businesses and in their supply chain. The law obliges medium-sized and larger businesses to map the risk of human rights violations throughout their supply chain.

In line with increased consumer awareness and demands, several Norwegian organisations, including Future in our hands, and the authorities have jointly created the Norwegian Transparency Act. Today, this ensures that Norwegian businesses involve millions of people in and outside Norway, to ensure that human rights and working conditions are good in the supply chain.

Who is covered?

The Transparency Act obliges medium-sized and larger businesses domiciled in Norway to comply with the requirements of the legislation. Foreign businesses that offer goods and services in Norway and that are liable to tax in Norway according to Norwegian internal legislation are also liable.

Businesses that are covered by Section 1-5 of the Accounting Act, or exceed the limits for two of the following three conditions, are covered by the Transparency Act:

- Revenue: NOK 70 million

- Balance amount: NOK 35 million

- Average number of employees in the financial year: 50 man-years

Small businesses will also be able to receive questions from their suppliers about their obligations, routines and subcontractors, related to violations of human rights and decent working conditions.

KPMG and the Consumer Research Institute SIFO, on behalf of the Ministry of Children and Families, have initiated work to evaluate the Transparency Act and any changes in connection with the Due Diligence Directive (CSDDD) and the Sustainability Reporting Directive (CSRD). Read more about this here.

Download guide for the Transparency Act

Get an insight into all the functions and processes that can help you deal with the Transparency Act. We have created a complete guide that takes you from anchoring in the board to due diligence assessments, risk assessment and reporting.

The Transparency Act vs CSDDD – what is the difference?

The EU’s due diligence directive, the Corporate Sustainability Due Diligence Directive (CSDDD), was adopted in the EU on 24 May 2024. In short, the due diligence directive requires large companies to carry out due diligence assessments and prepare a climate change plan. In the same way as the Transparency Act, the CSDDD requires due diligence assessments, but at a more detailed level. Furthermore, the CSDDD requires a comprehensive climate change plan, which the Transparency Act does not currently require, but which will very likely be included at a later date.

Violation of the directive obligations (CSDDD) may result in liability for damages. It does not appear on the government’s website how large the liability for damages is, but it is expected to be significantly higher than the Transparency Act. Liability for compensation in the Transparency Act is based on the seriousness, extent and effects of the infringement, but is based on up to 4% of annual turnover or up to NOK 25 million. Read more about penalty rates in the Transparency Act here.

CSDDD initially applies to large companies with more than 5,000 employees and a global net turnover of over 1,500 million euros. This will gradually be adjusted down to 1,000 employees and 450 million euros (5.3 billion NOK) in net turnover in 2029. Based on the article “Here are Norway’s 500 largest companies“, the law will then cover approximately 250 Norwegian companies in 2029. For comparison , the Transparency Act covers approximately 9,000 Norwegian businesses. The Openness Act covers businesses that include two of the following criteria: sales income of over NOK 75 million, balance sheet total of over NOK 35 million or over 50 man-years.

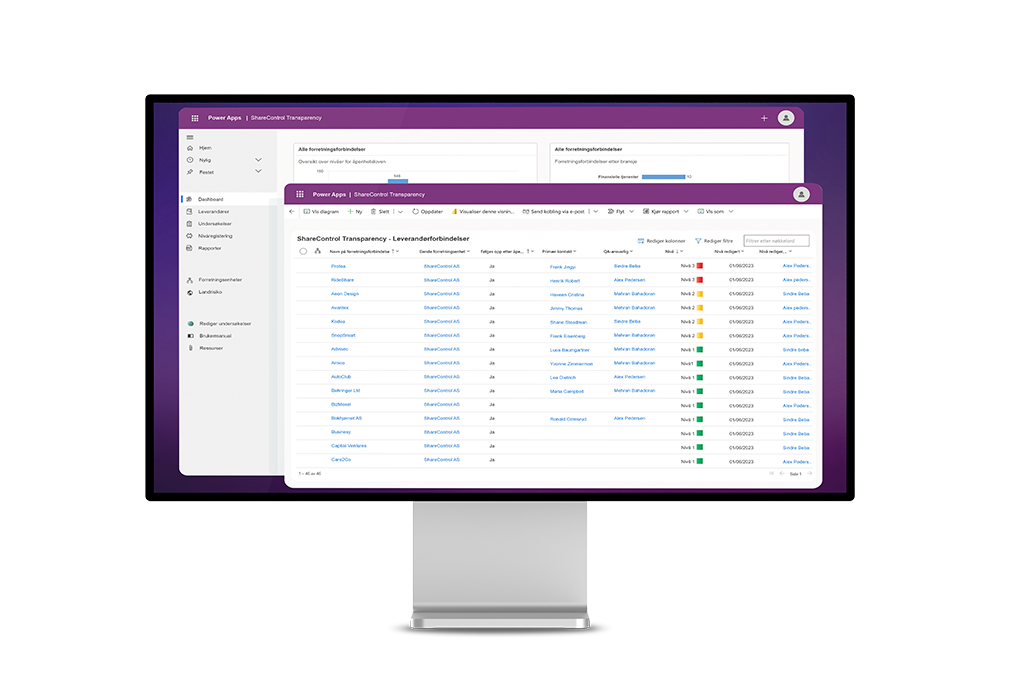

ShareControl Transparency – A system for handling the Transparency Act

With ShareControl Transparency, businesses can more easily meet the requirements of the Transparency Act by systematically collecting the data in one system. In this way, you can identify and handle information requirements and negative consequences related to human rights and working conditions in an efficient way.

Read also: Templates for the Transparency Act – a procedure for enforcing the Act’s requirements

ShareControl Transparency contains integration to Microsoft Forms and Customer Voice, so that you get a user-friendly platform to carry out due diligence assessments, report findings and follow up measures in an efficient way. Through automation and documentation, “ShareControl Transparency” makes it easier for businesses to keep track of complex supply chains and ensure that necessary measures are quickly implemented when negative consequences are discovered. This ensures better compliance with the law, increased transparency and improved accountability.