Do you still use Microsoft Excel or similar spreadsheets to manage your leases in accordance with IFRS 16? Do you still use Microsoft Excel or similar spreadsheets to manage your leases in accordance with IFRS 16?

IFRS 16 solution vs Excel

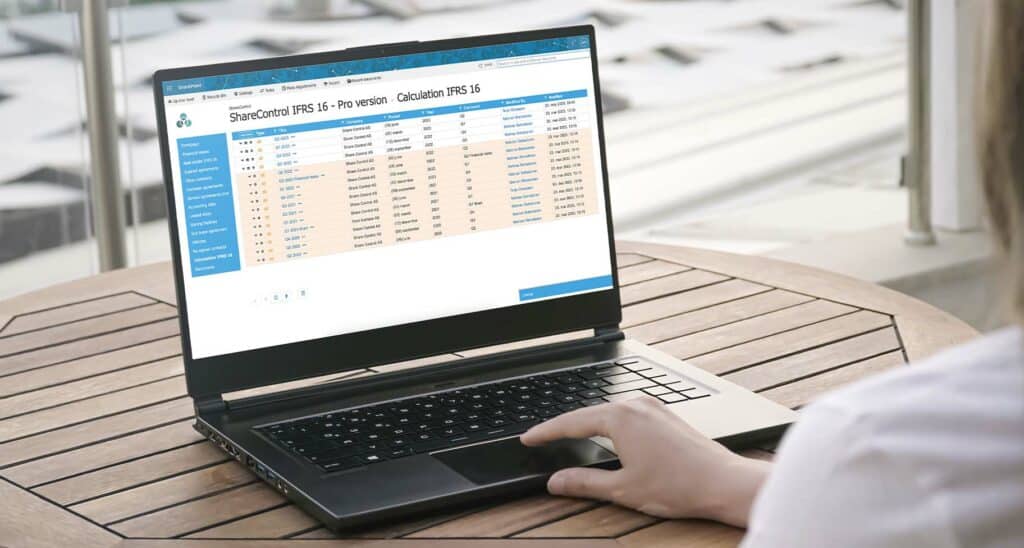

With a specialized IFRS 16 solution such as ShareControl IFRS 16, you don’t just go from handling data to optimizing the entire process. By adopting ShareControl IFRS 16, you ensure accurate data, reduce the administrative burden and simplify the entire process of complying with IFRS 16 requirements. But the benefits don’t end there. Let’s explore why this shift is important and how it can significantly improve your business’s lease management and accounting.

Read also: What is IFRS 16?

IFRS 16 handling in Excel vs IFRS 16 software

Many companies still use proprietary models in Excel that the companies themselves have developed for calculating and reporting IFRS 16. In Excel, the processes linked to IFRS 16 can be time-consuming and inefficient. Managing leases manually in Excel requires extensive manual work, including data collection, formula setup, and regular updates. This process is not only resource-intensive, but also vulnerable to errors and inaccuracies, which can lead to delays and potential errors in reporting.

Read also: Length of the rental period

By handling several agreements in manual systems, you risk spending a lot of time compared to a dedicated IFRS 16 solution. By implementing an IFRS 16 system, you can free up valuable resources and time that would otherwise be spent on manual work. This not only provides increased efficiency and accuracy, but also the opportunity to focus on strategic initiatives that can drive the business forward.

Compliance with regulatory requirements

Although Excel is a versatile tool, it can be challenging to comply with regulatory requirements such as IFRS 16. The Excel method requires manual updating and maintenance of the data, which increases the risk of errors and inaccuracies. In addition, Excel often lacks dedicated functions to handle complex IFRS 16 scenarios, such as the calculation of lease obligations and the identification of variables that affect the balance sheet and profit and loss account.

The lack of central IFRS 16 functionality can lead to non-compliance with accounting standards and increased chances of audit problems. With a dedicated IFRS 16 system such as ShareControl IFRS16, these functions are embedded and optimized to ensure accurate reporting and full compliance with regulatory requirements. This provides a safer and more reliable approach to rent administration and accounting, while reducing the risk of potential errors and consequences.

Traceability and audit trail

Traceability and audit trails play a crucial role in IFRS 16 compliance and accounting for leases. The IFRS standards require companies to maintain thorough documentation of all lease agreements and the associated accounting treatments. This includes detailed information on lease terms, calculations of lease obligations and assessments of cash flows. Furthermore, traceability and audit trails provide the opportunity to identify and address any errors or irregularities in the reporting at an early stage. This helps to prevent potential audit problems and inaccuracies in the accounting reports, which can have significant financial and reputational consequences for the company.

With traceability and an audit trail in a dedicated IFRS 16 system such as ShareControl IFRS 16, companies can effectively track and document all changes and decisions made during the life of the lease. This ensures that auditors and supervisory authorities can access an accurate history of all transactions and decisions relating to the lease.

Why implement an IFRS 16 solution rather than Excel?

Many still use Excel models for calculating and reporting IFRS 16. This method has its limitations in terms of the complexity and scope of leases, which can lead to errors and inaccuracies in reporting. The Excel method requires manual collection and organization of data, which can be time-consuming and prone to error. With the ever-increasing complexity of the IFRS 16 standards, the Excel method may be insufficient to meet the requirements for accurate and reliable reporting.

By handling several agreements in manual systems, you risk spending a lot of time compared to a dedicated IFRS 16 solution. Implementing an IFRS 16 solution such as ShareControl IFRS 16 frees up valuable resources and time that would otherwise be spent on manual work. This not only provides increased efficiency and accuracy, but also the opportunity to focus on strategic initiatives that can drive the business forward.

With traceability and an audit trail in ShareControl IFRS16, companies can effectively document and track all changes and decisions related to lease agreements. This not only ensures compliance with regulatory requirements, but also trust and transparency in the reporting process. By choosing a dedicated IFRS 16 solution over Excel, companies can achieve full compliance with accounting standards and reduce the risk of potential errors and consequences.

IFRS 16 solution on Microsoft 365

ShareControl IFRS 16, can help businesses with the implementation of IFRS 16 and all aspects of compliance with the IFRS 16 standard. The solution ensures compliance with the accounting standard and makes it easy to detect any errors with the system’s quality control in the calculations.

Security in Microsoft 365

Share Control is installed as an add-on, simply expressed as an app, on top of Microsoft 365 that refines and structures the functionality already found in Microsoft 365. Everything is therefore stored on SharePoint, Microsoft 365 storage space. For that reason, it is easy to move data without risking data loss.

Cost effectiveness with ShareControl IFRS16

ShareControl IFRS16 is a cost-effective solution for the user as it requires less administration, and since the calculations are done in a separate calculation model, it is easy to navigate and any errors can be updated quickly. In addition, the calculations are faster and can handle thousands of contracts simultaneously in “group calculators”.

Our experience is that customers adapt very quickly to the solution and once the system is installed, everything runs automatically. For those who need it, we are at hand, but we also have an easy-to-use guide.

– Ragnar Bryne, CEO of Share Control AS

IFRS 16 handling during Covid 19

The consequence of the Corona pandemic has meant that many agreements will be renegotiated and changes must be registered in accordance with IFRS 16. A good system will be able to handle this in an efficient and correct way.

– It will be a challenge for many companies to implement the changes. With ShareControl IFRS 16, it is easy to make corrections without having to change many different places. Another advantage of a third-party provider such as Share Control is that you avoid a single person having the entire calculation file stored locally with them. There are also advantages in that Share Control already has many customers who use the system.

Find out more about ShareControl IFRS 16

– We have over 500 users, many of whom are large companies, including Aker Solutions. This means that we are constantly receiving feedback and making improvements. Users pay to continuously create new versions, updates and make sure everything works as it should. IFRS 16 is complicated and our job is simply to follow what is happening, says Ragnar Bryne, general manager of Share Control.

Read more about the handling of IFRS 16 during Covid-19